March 6, 2025 - 16:15

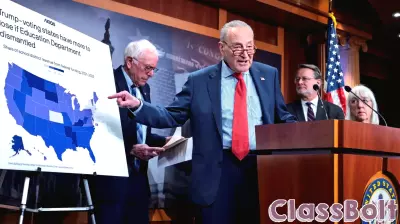

The potential closure of the Department of Education raises significant concerns for millions of Americans burdened by student loan debt. According to recent findings from the Pew Research Center, approximately one in four individuals under the age of 40 is currently managing student loans. The implications of shutting down this critical agency could be far-reaching, affecting loan servicing, repayment plans, and borrower protections.

Without the Department of Education, oversight of federal student loans may become fragmented, leading to confusion and uncertainty for borrowers. The absence of a centralized authority could hinder the implementation of existing relief programs and complicate the process for those seeking assistance. Additionally, the closure could stall any new initiatives aimed at alleviating student debt, leaving many borrowers in limbo.

As discussions about the future of the Department of Education continue, it is crucial for policymakers to consider the potential ramifications on student loan borrowers and to explore solutions that protect their interests. The stakes are high for this demographic, and the need for a robust support system remains paramount.